Conversation 166: Intuitive Surgical Inc.

Intuitive Surgical NASDAQ: ISRG plus Atlassian [ASX:TEAM] and Square Inc [NASDAQ:SQ].

Intuitive robots carry out a surgical procedure every 26 seconds.

Intuitive Surgical, listed on the NASDAQ, is an American based robotic surgical company which has conducted more than seven million procedures, one every 26 seconds according to their website] and mostly in the area of laparoscopy.*

I hadn’t heard of the company until my recent chat with Michael Smith, Founder and Chief Investment Officer of Kauri Investments, which has a holding in Intuitive. So I was keen on finding out why he has invested in Intuitive, hence this post.

During the Conversation we also talked about Atlassian [ASX:TEAM] and Square Inc [NASDAQ:SQ].

You can read more about Intuitive here.

*Laparoscopy, also known as diagnostic laparoscopy, is a surgical diagnostic procedure used to examine the organs internally through a low-risk, minimally invasive procedure that requires only small incisions.

[IMPORTANT: THIS ARTICLE AND INTERVIEW IS BY NO MEANS A DEFINITIVE EXPLORATION OF THE BUSINESS FEATURED AND NO INVESTMENT DECISIONS SHOULD BE MADE BASED ON THIE INFORMATION FOUND ANYWHERE ON THIS WEBSITE. PLEASE READ OUR FULL DISCLAIMER BEFORE MAKING ANY INVESTMENT DECISIONS ABOUT ANY COMPANIES MENTIONED ON THIS WEBSITE AND SEEK THE ADVICE OF A PROFESSIONAL ADVISOR.]

Useful blog navigation links.

SHARE PRICE TREND OVER 200/100/9 DAYS l SOME OTHER ANALYST VIEWS

ABOUT INTUITIVE:

Intuitive was founded in 1995 creating robotic-assisted systems that help doctors and hospitals to make surgery less invasive than an open approach. Intuitive’s da Vinci surgical system was one of the first robotic-assisted systems cleared by the FDA for general laparoscopic surgery. Laparoscopy, also known as diagnostic laparoscopy, is a surgical diagnostic procedure used to examine the organs internally through a low-risk, minimally invasive procedure that requires only small incisions.

Intuitive Surgical hasWorking with doctors and hospitals, we’re continuing to develop new, minimally invasive surgical platforms and future diagnostic tools to help solve complex healthcare challenges around the world.

INTUITIVE HAS TWO MAIN PRODUCTS:

The fourth-generation da Vinci Surgical Systems which the company says continues to advance Minimally Invasive Surgery (MIS) across a wide spectrum of surgical procedures via flexible configurations, upgradable architecture and a consistent interface.

The Ion endoluminal system is a robotic-assisted platform for minimally invasive biopsy in the lung. The system features an ultra-thin, ultra-maneuverable catheter that allows navigation far into the peripheral lung, and claims unprecedented stability to enable the precision needed for biopsy.

HOW INTUITIVE HAS BEEN EFFECTED BY COVID

“Second quarter 2020 revenue was $852 million, a decrease of 22% compared with $1,099 million in the second quarter of 2019. Lower second quarter revenue was driven by lower procedures volume and system placements, primarily as a result of the significant disruption caused by the COVID-19 pandemic, as well as a $59 million decrease in service revenue related to service fee credits from the previously announced Customer Relief Program.”

Editor’s note: I have posted, a little later in this article, the most recent Quarterly Financial Results announcement by ISRG, along with a comparative year old quarterly. The latter was pre COVID and showed good growth for Intuitive Surgical to that point.

The two Intuitive Surgical Robot systems. Left da Vinci and right, Ion.

GIANT J&J SAYS IT HAS TO DELAY THEIR ROBOT COMPETITION TILL AT LEAST LATE 2022

SOME OF THE RECENT MARKET ANNOUNCEMENTS BY INTUITIVE SURGICAL:

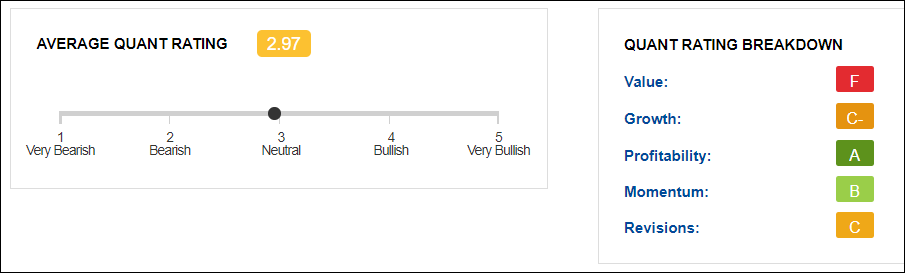

SOME RATINGS FOR INTUITIVE SURGICAL [NASDAQ:ISRG]

RATING BELOW ARE FROM SEEKING ALPHA AND WERE CURRENT ON TUESDAY 20TH AUGUST 2020

IT SEEMS THAT THE LIVING BREATHING ANALYSTS ARE MORE CONFIDENT ABOUT INTUITIVE’S CHANCES OF REPELLING BORDERS LIKE J&J THAN THE QUANT SYSTEMS.

DISCLOSURE

The author does not own shares in this company at the time of writing this post. Inside Market does not accept any payment from this or any other company we cover. Inside Market charges a licensing fee for the re-publication of any content on this site. Any information in this article or anywhere on the InsideMarket site should be considered in any way, a recommendation to invest in this or any other company covered here. Nor should it be seen as a form of financial or investment advice. Disruptive technology stocks should be considered very speculative, high-risk, and extremely volatile. There are significant risks inherent in developing new technologies that are not discussed here. You should always seek professional advice before considering any share purchase or sale. Please read our full disclaimer. Insidemarket.net is intended for general news and information purposes only. Nothing in Insidemarket.net constitutes or is intended to constitute investment, financial, property, business, marketing, accounting, mortgage or legal advice and should not be relied upon by any person as a substitute for professional advice. Readers are strongly encouraged to seek independent legal, financial or other relevant or applicable advice before making any related decision. READ FULL DISCLAIMER HERE

* The Morningstar rating uses a machine-learning model to rate 22 times more funds than are rated by Morningstar analysts in EMEA and Asia.

The Quantitative Rating is an extension of the recently enhanced Morningstar Analyst RatingTM for funds (Analyst Rating), which provides an analyst's forward-looking assessment of a fund's ability to outperform its peer group or a relevant benchmark on a risk-adjusted basis over a full market cycle. Morningstar EMEA and Asia manager research analysts assign Analyst Ratings to approximately 1,260 open-end and exchange-traded funds and together with the Quantitative Rating, cover approximately 29,200 funds, representing nearly 105,000 share classes in EMEA and Asia.